Previous MIP (Executive MBA)

Founded in 2013 VSV Capital (Vietnam Silicon Valley) is a holding with a wide range of capital solutions, including a 4-month seed stage accelerator program backed by VIB Bank (one of the largest retail bank in Vietnam), private investors and the Vietnamese Ministry of Science & Technology (MOST). Since its launch in 2014 VSV Accelerator graduated 100+ startups in multiple batches.

Vietnam Silicon Valley (VSV) received hundreds of applications in every batch. Applications span across nations, industries and technologies. VSV had to ensure to select the best fitting teams for the program in order to maximize the success rate of the accelerator

We supported VSV in the startup selection process and screened, evaluated, and shortlisted many hundreds applications for their 3rd batch. During the programs we provided a weekly hands-on consulting and operational support spanning venture growth, go-to-market and investment-readiness & fundraising topics.

“ FFA has been a key resource for our portfolio, providing plenty of valuable knowledge and hands-on support to our teams. And we value to still having them in our mentor roster to keep supporting companies moving forward. “

“ FFA has been a key resource for our portfolio, providing plenty of valuable knowledge and hands-on support to our teams. And we value to still having them in our mentor roster to keep supporting companies moving forward. “

Founded in 2013 VSV Capital (Vietnam Silicon Valley) is a holding with a wide range of capital solutions, including a 4-month seed stage accelerator program backed by VIB Bank (one of the largest retail bank in Vietnam), private investors and the Vietnamese Ministry of Science & Technology (MOST). Since its launch in 2014, VSV graduated 100+ startups in multiple batches. Some notable alumni from this program are Lozi (backed by Golden Gate Ventures), TechElite, Hachi (winner of Lotte startup competition) and eKID (winner of Hatch! Battle and graduated in the Hebronstar HCamp). Full portfolio can be found here.

FFA supported VSV on managing the acceleration program, supporting the VSV team in screening the applications and interviewing candidates, mentoring each team weekly on growth and fundraising topics and preparing each of the 8 startups for demo day with a dedicated Investor Readiness & Fundraising Bootcamp.

The accelerated startups have since then raised seed funding, won international awards and closed strategic partnerships with MNC.

VSV main challenges and needs included:

1. Startup screening and selection

VSV received hundreds applications of applications in every batch. Applications span across nations, industries and technologies. VSV had to ensure to select the best fitting teams for the program in order to maximize the success rate of the accelerator.

2. Program execution support

VSV had a strong core team able to deliver educational and coaching content on key areas (such as value proposition design, business model canvas, entrepreneurship support, providing tools and best practices) but due to the lean organization they lacked experts dedicated to continuously supporting the teams along their journey in the accelerator, especially on topics in which a network outside of Vietnam would be very useful

We provided a full Portfolio Development & Growth Service to the accelerator program’s team at VSV, including:

1. Startup selection

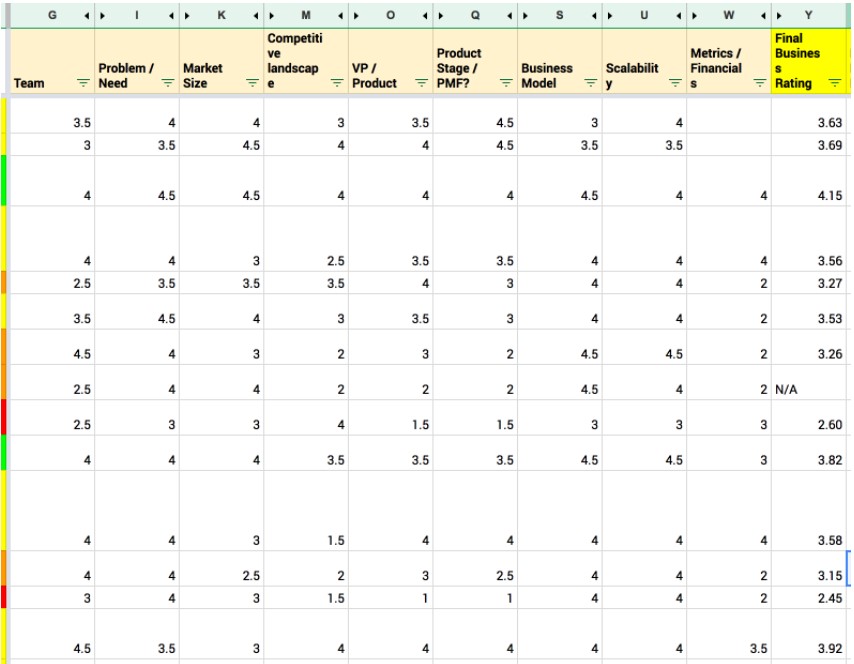

Screened over 100 applications and rated them based on our internal model, which is focusing on evaluate potential of the team on 9 key elements (like Team & Coachability, Value Proposition & Product, Business Model, Market Size, Competition, Product Market Fit PMF, Metrics and KPIs, Scalability)

Shortlisted startups have been interviewed remotely and then onsite to come up with the final list to be approved by the accelerator investment committee and LPs.

2. Ongoing hands-on and operational support

During the 4-month acceleration programs, FFA provided weekly onsite & remote support for the startups in the batch on growth, go-to-market, and fundraising topics. Every startup received targeted and tailored advice and we acted as a sparring partner ensuring accountability on the actions required every week. FFA deployed its team of analysts to provide dedicated growth support activities (market and lead research, setting up of analytics, to name a few), in order to save as much time as possible to the startup founders and teams.

3. Investor readiness bootcamp

In order to prepare the teams for the Demo Days, which took place at the TechFest events, FFA conducted Investor Readiness Bootcamp to prepare and fine tune the pitches of each portfolio company

OUR IMPACT

After the program of the 3rd batch companies scored multiple achievements: