Previous VSV Capital (Vietnam Silicon Valley)

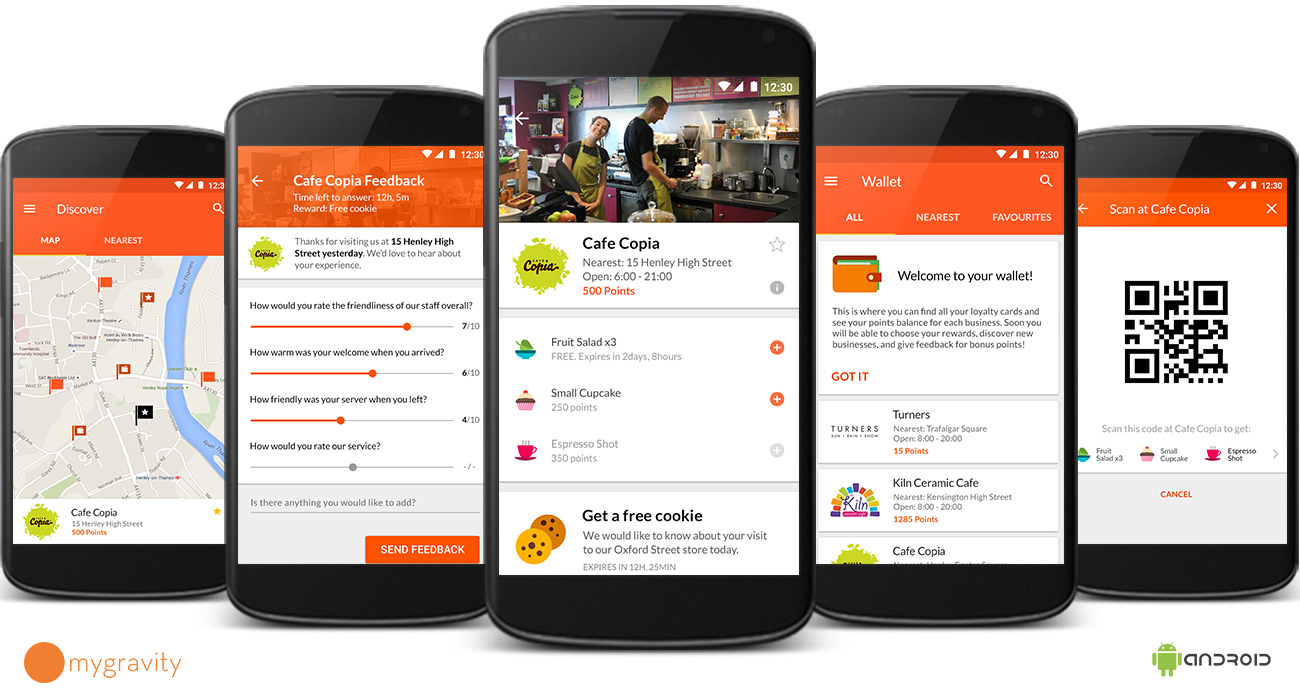

MyGravity was founded with the goal to revolutionize the corporate customer personal data management and loyalty space, with the vision to create an open platform and marketplace for personal data information, on which both businesses and customers could be able to manage, enrich, update, withdraw personal data from the different stakeholders.

The very first pitch deck was too much focused on the vision of the personal data management platform and little information was provided on how to concretely and milestone-based to reach that (and what business model, validation points and funding would be needed to support it).

We supported MyGravity via our Fundraising Booster (FRB) Service to build an business and investment case that is investment-readiness and venture-worthy, to prepare their data room and investment materials, and to execute the seed fundraising

“ Frank and team have been supporting us every week for over 1 year on hitting milestones and metrics to reach investment-readiness and on preparing all the materials, which led to our bridge seed round and subsequently to our exit. Highly recommended! “

“ Frank and team have been supporting us every week for over 1 year on hitting milestones and metrics to reach investment-readiness and on preparing all the materials, which led to our bridge seed round and subsequently to our exit. Highly recommended! “

MyGravity was founded with the goal to revolutionize the corporate customer personal data management and loyalty space, with the vision to create an open platform and marketplace for personal data information, on which both businesses and customers could be able to manage, enrich, update, withdraw personal data from the different stakeholders. To build this vision, MyGravity started to roll-out loyalty programs for SMEs with a hyperlocal approach.

In 2013 they raised a large angel and F&F round that covered their initial development.

MyGravity appointed Fast Forward Advisors to help them reach investor-readiness and be able to raise either a Bridge Seed or a Series A round in the UK and the US.

The main problems of MyGravity were the following:

1. Missing growth plan and investment case

The very first pitch deck was too much focused on the vision of the personal data management platform and little information was provided on how to concretely reach a critical mass to positively validate that the business and business model is viable and potentially venture-worthy to be invested in.

2. Fundraising with no market validation

Like all tech ventures nowadays, MyGravity was highly interested in fundraising, in order to survive the valley of death of the data management / marketplace model. But this model requires huge amounts of money and there was very little proof-of-market and validation that could be obtained at each growth stage, making fundraising practically impossible.

1. Phase 1: Reaching investment-readiness and venture-worthiness

We worked with MyGravity with our FRB Service, first on the Phase 1 “fundraising preparation work”. We helped to identify, which elements in their business and investment case were not investment-ready in terms of a venture-worthy business. We tried to break down the value proposition (being long-term personal data platform and marketplace) into more short-term focused, measurable and milestone-driven selling propositions. All of this had to be distilled into a pitch deck and financial kit at the end that would show short-term traction and KPIs, but give an idea about the long-term vision and potential of the company.

2. Phase 2: Fundraising Execution

As part of the Phase 2 “fundraising execution” of our FRB Service, we supported MyGravity in

OUR IMPACT:

Closed 7-figure bridge seed funding

MyGravity reached a maturity of investor-readiness, which contributed to raising a 7-figure bridge seed round from investors in the UK (including OION – Oxford Investment Opportunity Network, investment crowd on crowdcube.com and existing angels).

M&A Exit

After a successful growth of their My360 app in the UK with the collected funds, MyGravity accepted an acquisition offer from Loyalty Angels Ltd (trading under Bink), the growing loyalty platform backed by a very strong funding from top-tier venture capital and strategic investors.

Fast Forward Advisors is still a shareholder in Bink Ltd. and is still providing soft support to the shareholders, directors, and management.