Previous Ship60

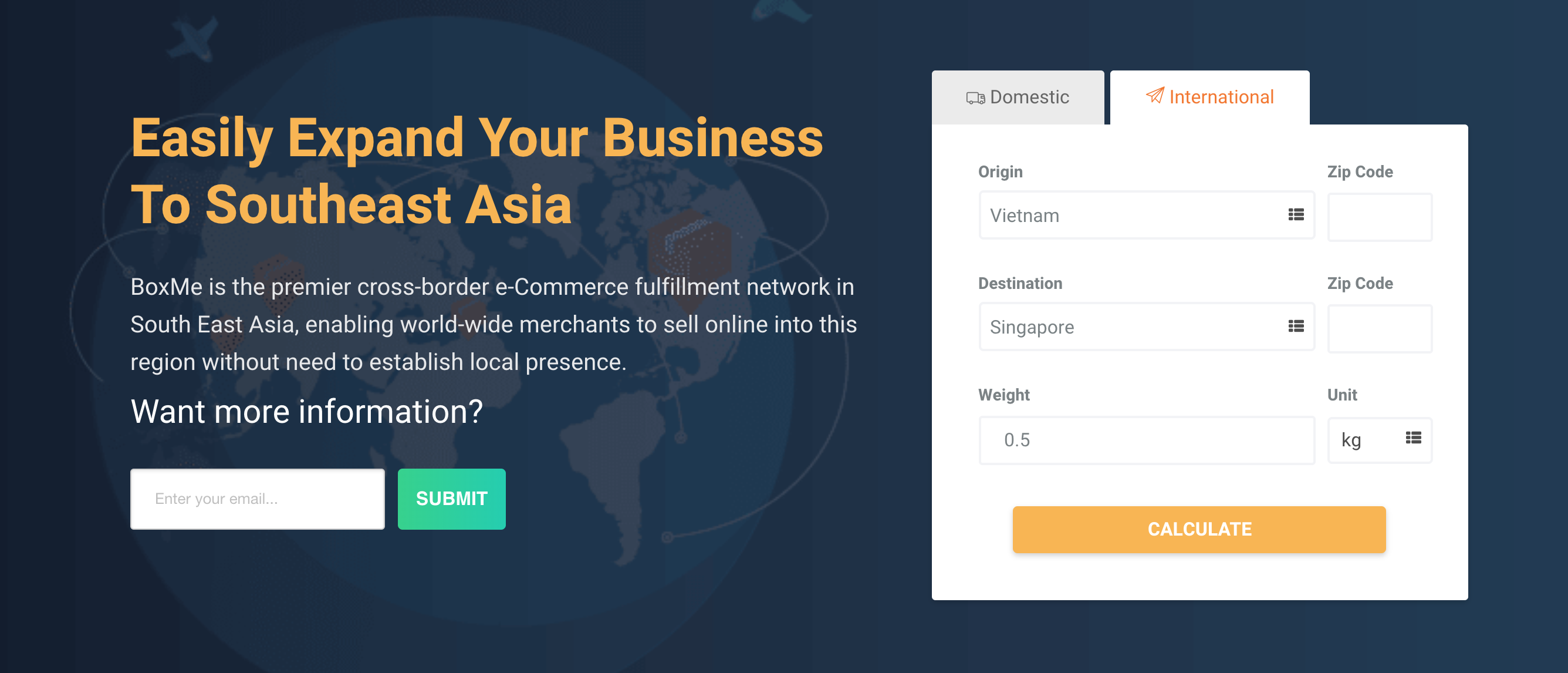

Founded in 2015, Boxme is a fulfillment network in Southeast Asia that enables worldwide merchants to sell into the region without establishing local presence, providing an advanced technology to maximize clients’ full potential in logistics.

Boxme wanted to raise a formal venture funding round to accelerate their growth, but had different issues like their complicated organizational structure or the lack of a clear value proposition caused by growing the number of their products and services.

We worked with Boxme and their venture builder Nexttech.Asia to provide solutions to the challenges like the value proposition design and consolidation, company structure restructuring, the collection and production of growth data, financial data, and the creation of an venture-worthy investment case and fundraising materials.

” FFA was of great support in addressing some open internal challenges in our organization and provided the best guidance I could hoped for during the investment preparation “

” FFA was of great support in addressing some open internal challenges in our organization and provided the best guidance I could hoped for during the investment preparation “

Founded in 2015, Boxme is a fulfillment network in Southeast Asia that enables worldwide merchants to sell into the region without establishing local presence. Boxme offers last-mile delivery, international shipping, warehousing and fulfillment services. Boxme builds up its capability by partnering with local logistics partners (subject to revision). After over 2 years of operation, the model has proven to be successful, allowing the company to obtain gross revenue of $1.73 million for the first 10 months of 2017.

Boxme wanted to raise a formal venture funding round to further develop its presence in Vietnam and Thailand as well as finance its expansion into four other Southeast Asian countries, namely Malaysia, Indonesia, Singapore, and Philippines.

The company felt that they had different issues with their investment readiness:

We provided solutions on the following

Our Impact