Previous Hub:Raum (Deutsche Telekom)

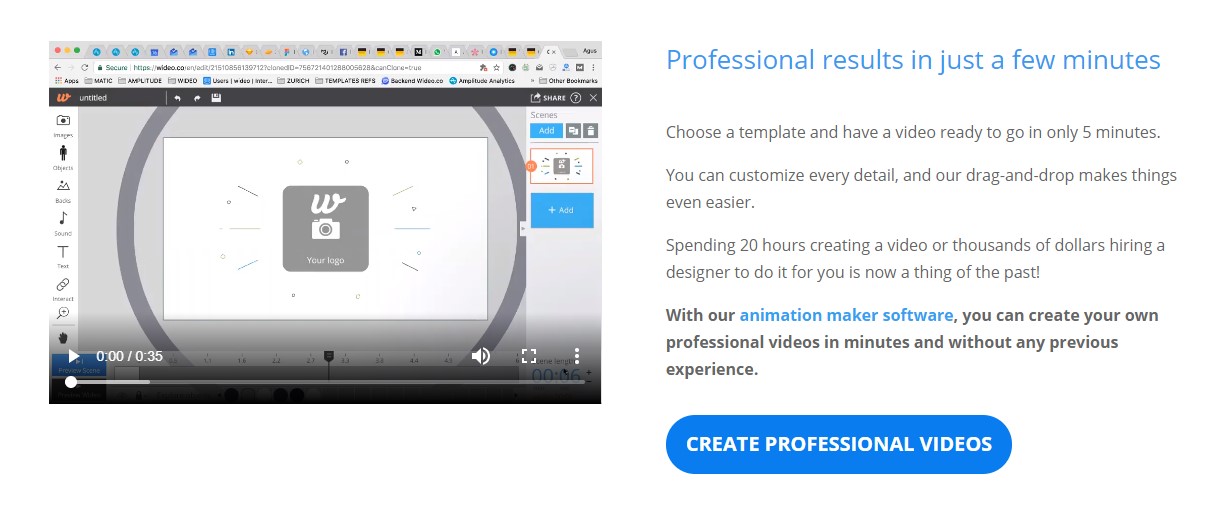

Wideo is a tech company providing simple online DIY multimedia software tools for non-professionals to create their own explainer and marketing support videos and presentations in the cloud. Their core team is in Buenos Aires (Argentina), but due to investments and strategic location, they moved their HQ to San Francisco (USA).

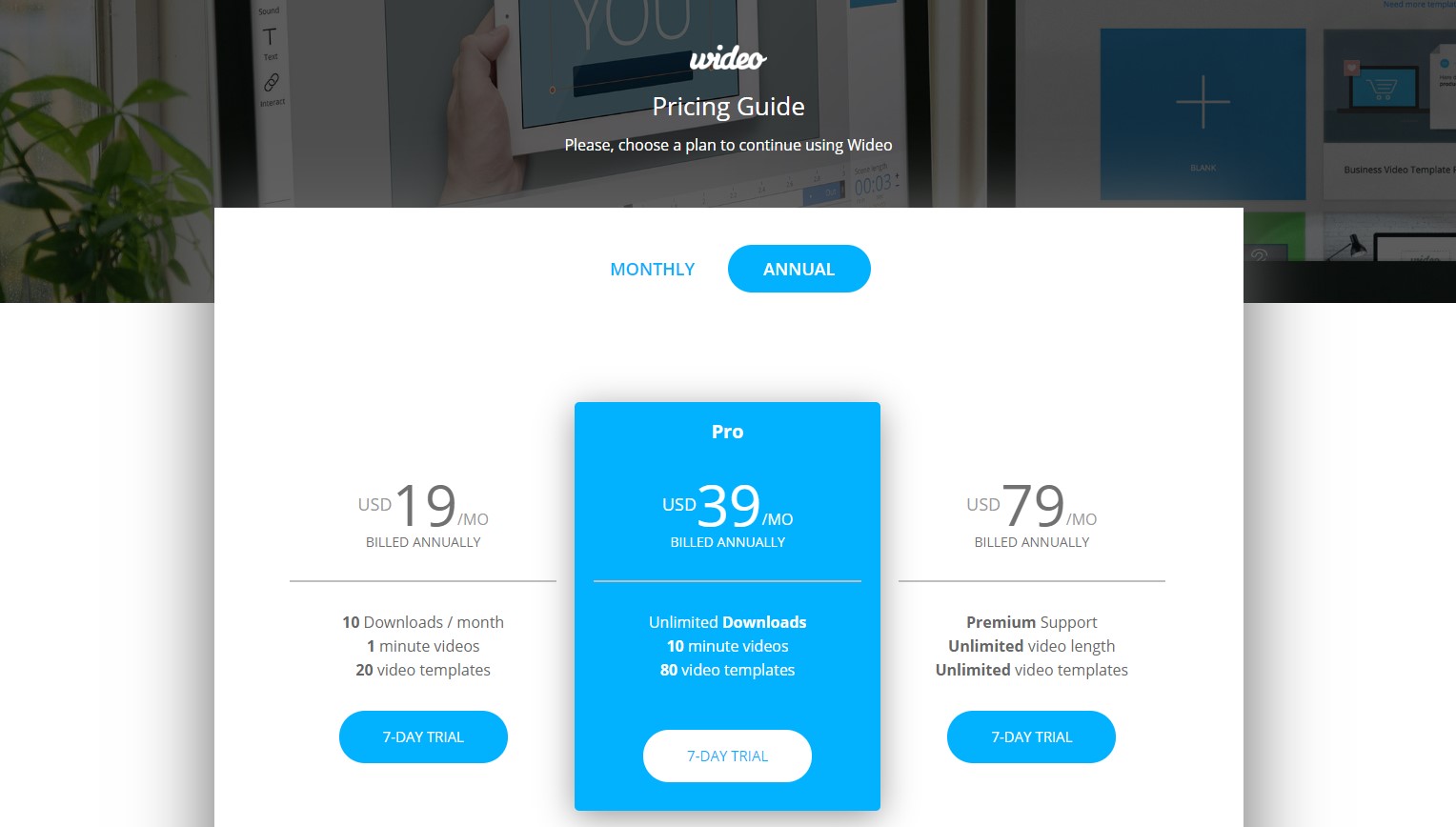

Wideo was trying to raise a Series A round after raising 2 Seed rounds from including NXTP Labs, 500 Startups and Angels from the 500 network. But they felt that they were not ready in terms of Market Validation and Segmentation which was putting pressure on the growth KPIs (market growth rates, churn rates, ecc).

FFA worked with Wideo on their investment readiness, and implemented a growth re-engineering process focused on creating

” FFA provided us with a lot of insights into problems and issues in our Series A pitch deck in terms of content and market/growth validation. From those problems, we embarked on a growth re-engineering process which helped us to identify our main value drivers and to focus on our strongest customer segments. “

” FFA provided us with a lot of insights into problems and issues in our Series A pitch deck in terms of content and market/growth validation. From those problems, we embarked on a growth re-engineering process which helped us to identify our main value drivers and to focus on our strongest customer segments. “

Wideo is a tech company providing simple online DIY multimedia software tools for non-professionals to create their own explainer and marketing support videos and presentations in the cloud. Their core team is in Buenos Aires (Argentina), but due to investments and strategic location, they moved their HQ to San Francisco (USA).

Wideo first engaged FFA to help them raise an international venture capital series a funding round (by researching and introducing European investors to potentially syndicate a deal with US ones to open both geographical markets), but after analyzing the investment readiness we found out that Wideo needed to undergo a major growth re-engineering to have a more solid support for their investment case.

In 2014 Wideo raised some relevant 7-figure seed funding rounds from NXTP Labs and 500 Startups, with an interesting board of seasoned professionals from the multimedia and creativity software industry.

Wideo was trying to raise a Series A round after raising 2 Seed rounds from including NXTP Labs, 500 Startups and Angels from the 500 network. They on-boarded advisory board from some Fortune 500 corporations in the creative software industry and were ready to embark on the VC fundraising journey.

The idea was to raise a funding round in both the US and Europe to support market entry with the investors’ networks and expertise/experience in the market, but Wideo felt that they were not ready:

To start with FFA worked with Wideo on the investment readiness. We went through their KPI dashboard and operational details and assessed the VC investment readiness, which as explained above was shaky. We provided an idea on how we could solve the issues on growth strategy and operations, in order to build a more solid business and investment case.

We suggested working with our Growth as a Service (GaaS) framework, but not to use it for experimenting and validating growth for the existing product and market, but to use it for “re-engineering” of the existing growth setup and processes. We set to work and reiterate on market experiments, internal improvements and growth setups with an agile process organized in Growth Sprints of 2 weeks each.

In a 12 Growth Sprints (24 weeks) project with remote work, FFA supported Wideo in this “re-engineering” effort, by focusing on these main activities: