Previous Proteus Labs

Intesa SanPaolo Innovation Center is the corporate and startup innovation center by Intesa SanPaolo, an Italian-HQed banking giant. One of their initiatives is called Startup Initiative, in which they support tech startups and scaleups of their client network or from their ecosystem to grow.

Since Intesa SanPaolo Innovation Center was looking to add partners that were focused on supporting tech startups on growth and go-to-market that would be generalist enough to handle all of their verticals, have strong knowledge of the local and regional ecosystem, but had international experience, networks, and exposure.

We joined the Intesa SanPaolo Innovation Center partner network as tech venture growth experts, providing support in dozens of internally pitching sessions, being a sparring partner and providing actionable insights and tools to improve the growth cases of the 700+ portfolio companies across all industries.

“ FFA has been one of our longest standing mentors and consultants, supporting us since the early days of the Startup Initiative. They provided immense value on growth engineering and go-to-market in tech. ”

“ FFA has been one of our longest standing mentors and consultants, supporting us since the early days of the Startup Initiative. They provided immense value on growth engineering and go-to-market in tech. ”

Intesa SanPaolo Innovation Center is the corporate and startup innovation center by Intesa SanPaolo, an Italian-HQed banking giant. One of their initiatives is called Startup Initiative, in which they support tech startups and scaleups of their client network or from their ecosystem to grow.

Intesa SanPaolo Innovation Center doesn’t provide expert support and value creation internally and rely on external collaborations with different stakeholders in the local and international tech ecosystem to provide niche services to their portfolio companies.

Since Intesa SanPaolo Innovation Center was looking to add partners that were focused on supporting tech startups on growth and go-to-market that would be generalist enough to handle all of their verticals, have strong knowledge of the local and regional ecosystem, but had international experience, networks, and exposure.

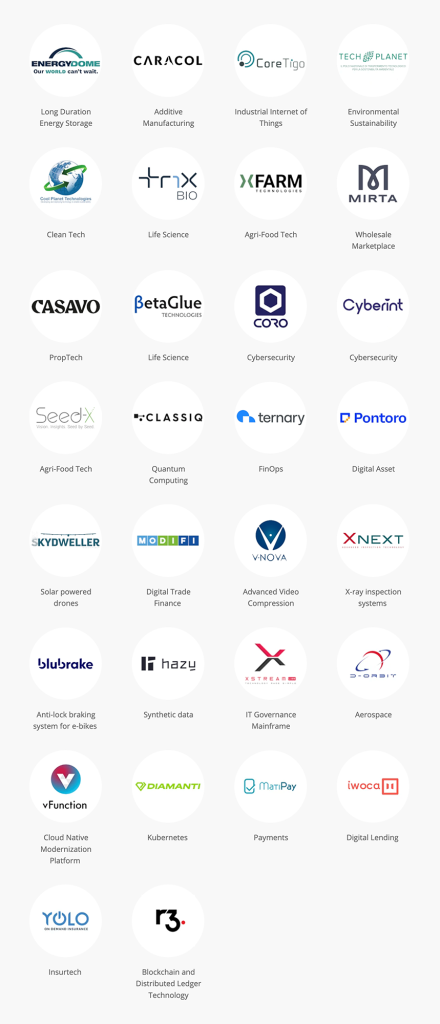

Industries include:

https://www.intesasanpaoloinnovationcenter.com/en/startup-development/acceleration/

We joined the Intesa SanPaolo Innovation Center partner network as tech venture growth experts, providing support in

dozens of internally pitching sessions, being a sparring partner and providing actionable insights and tools to improve the growth cases of the 700+ portfolio companies across all industries.

The services included:

A series of companies that went through the programs raised a follow-on round from the corporate venture arm Nexa SGR, which portfolio companies can be found here https://www.nevasgr.com/content/neva/en/portfolio.html and details of the investments can befound here https://www.crunchbase.com/organization/neva-a608