Previous Stylelend (YCombinator)

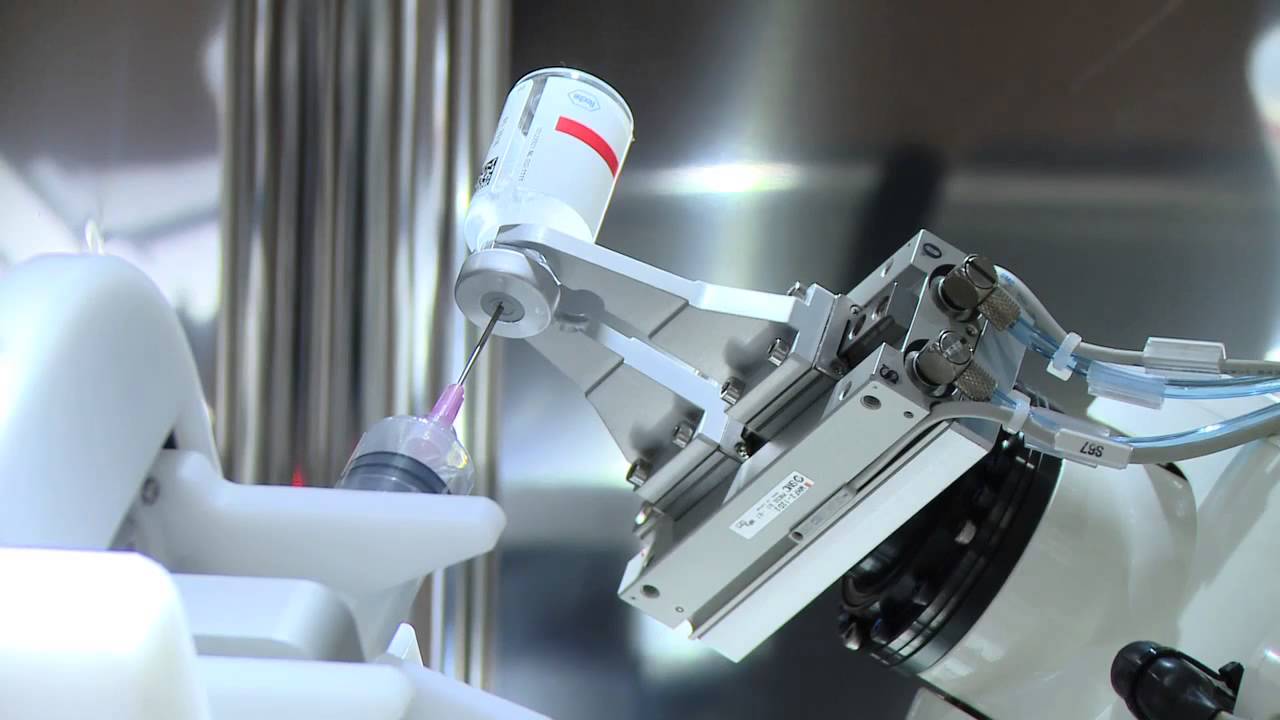

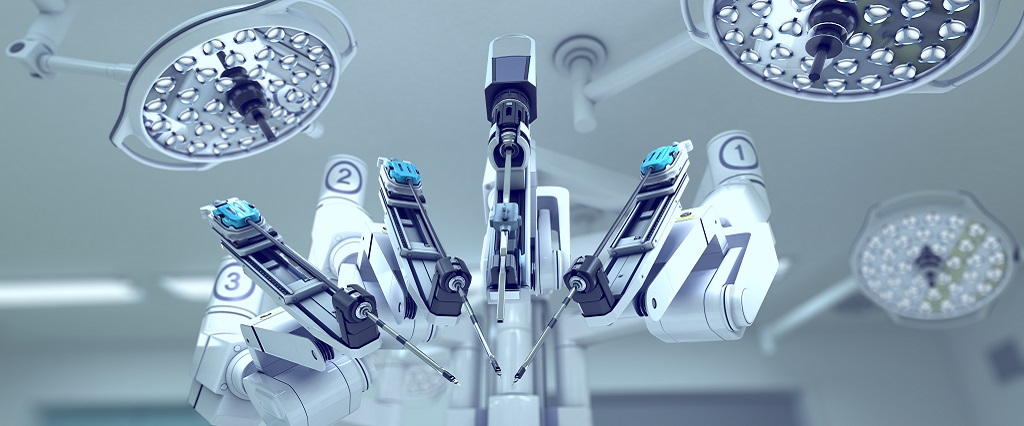

Founded in 2006 in Bolzano – Italy (the same town actually in which Fast Forward Advisors was founded in 2011) Health Robotics is a medical technology company developing automated and semi-automated i.v. rooms and stations for the preparation, storage and dispatching of non-toxic and toxic drugs for infusion or injection therapies.

In the early stages of the company they were focusing on the high-tech R&D and product development together with the business development, meaning that there was neither the focus nor the budget to really dig into these topics. They also lacked a network of independent investors, which were limited to personal connections from the medical technology world (meaning mostly strategic investors).

We started working with Health Robotics on explaining about the chances and opportunities that Venture Capital could bring to them in terms of growth acceleration. For a team that came from a highly technical and corporate environment understanding entrepreneurial finance and its pros and cons was not trivial. We drafted different growth scenarios (in different markets, like the US) based on the potential fundraising targets. We supported in preparing the materials and presentations needed to support the investment cases.

“ Working with FFA enabled us to fully understand which path we could take in terms of venture capital or private equity investments and were very supportive along the whole process “

“ Working with FFA enabled us to fully understand which path we could take in terms of venture capital or private equity investments and were very supportive along the whole process “

Founded in 2006 in Bolzano – Italy (the same town actually in which Fast Forward Advisors was founded in 2011) Health Robotics is a medical technology company developing automated and semi-automated i.v. rooms and stations for the preparation, storage and dispatching of non-toxic and toxic drugs for infusion or injection therapies.

Started out with a 4-headed team, Health Robotics had a massive growth (consistently 3-figure % year-to-year growth) and in 2014 was acquired by Aesynt, a leading US company offering integrated pharmacy automation solutions, with 9-figures revenues and 8-figures EBITDA.

In 2011-2012 Fast Forward Advisors supported Health Robotics to understand their potential venture-backed path and provided contacts and options on the venture capital and private equity markets.

The main problem of Health Robotics in 2011 was the following:

No experience in Entrepreneurial Finance and Venture Capital

In the early stages of the company they were focusing on the high-tech R&D and product development together with the business development, meaning that there was neither the focus nor the budget to really dig into these topics. They also lacked a network of independent investors, which were limited to personal connections from the medical technology world (meaning mostly strategic investors).

Also they were growing consistently and a stronger pace than ever, and they needed to fuel that growth with venture funding, because of the high CAPEX nature of the business.

1. Entrepreneurial Finance Mentoring

We started working with Health Robotics on explaining about the chances and opportunities that Venture Capital could bring to them in terms of growth acceleration. For a team that came from a highly technical and corporate environment understanding entrepreneurial finance and its pros and cons was not trivial. We drafted different growth scenarios (in different markets, like the US) based on the potential fundraising targets. We supported in preparing the materials and presentations needed to support the investment cases.

2. Phase 2: International Fundraising

As part of the Phase 2 “fundraising operations” of our standard Startup International Fundraising package, we supported Health Robotics in:

a) creating a long-list of investors by crawling through our internal databases (with past transactions), investors via 2nd rank introductions and our own specific research.

b) reaching out and short-listed interested investors (and managed feedback loops and arrangement of 1-1 meetings)

Reached Investor-readiness

Health Robotics reached a level of investor-readiness, which enabled them to attract interest from different Venture Capital and Private Equity investors in Europe. After discussing investment opportunities with different funds they concluded that want to grow independently without external funding. Even if the decision can be challenged, this didn’t stop their growth, which continued steadily. In 2014 Health Robotics was acquired by Aesynt, a leading US company offering integrated pharmacy automation solutions, for an undisclosed amount, which, in turn, in 2016 was acquired by the Omnicell Group (NASDAQ: OMCL) for USD 275M.