Previous Wideo (500)

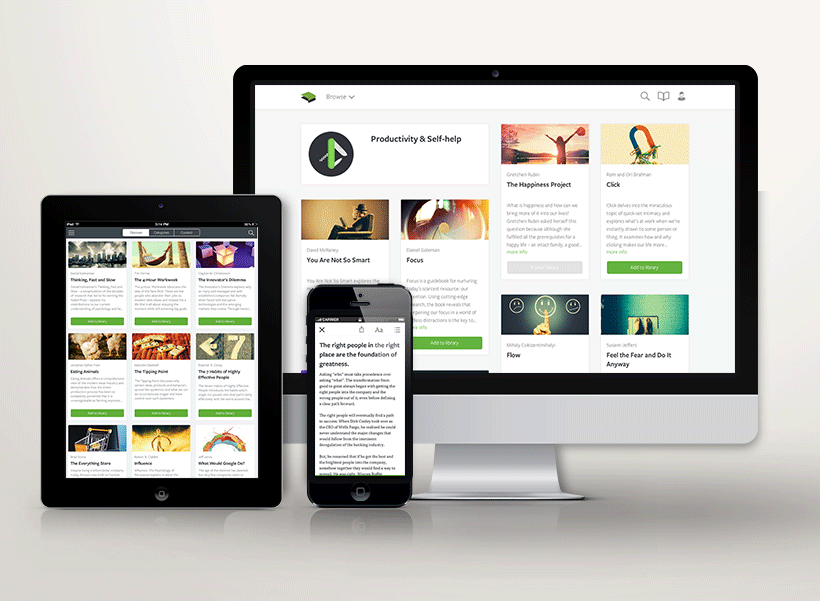

Founded in 2011 Blinkist is a consumer app that enables everybody to become more knowledgeable by reading key insights from 2200+ bestselling nonfiction books, which are transformed into powerful packs (blinks) that can be read or be listened to in just 15 minutes.

The main challenge for Blinkist in the early stages was to shine light on every potential traction channel, specifically the B2B and B2B2C channels that were never strategized and tested before and could enable a new low-churn commercial channel for the company.

We worked with Blinkist to execute a full experimentation and validation cycle on a potential B2B / B2B2C setup (corporate or a media partnership). The activities comprised setting up a value proposition, product package, pricing, identifying the best corporate and media targets, and setting up a funnel with which to outreach, engage, and close potential interested counterparts.

“Working with FFA enabled us to understand the complexities and opportunities of a B2B / B2B2C strategy, which at that time was out of our reach. “

“Working with FFA enabled us to understand the complexities and opportunities of a B2B / B2B2C strategy, which at that time was out of our reach. “

Founded in 2011 Blinkist is a consumer app that enables everybody to become more knowledgeable by reading key insights from 2200+ bestselling nonfiction books, which are transformed into powerful packs (blinks) that can be read or be listened to in just 15 minutes.

In 2012 they entered the Deutsche Telekom Accelerator hub:raum in Berlin, which enabled the first growth elements.

To date 2022 Blinkist raised over USD 34.8M in 4 rounds from international VC powerhouses and their growth has been ramping up globally.

In 2013-2014 Fast Forward Advisors supported Blinkist in their early stages to identify suitable B2B / B2B2C approaches in their strategy and to identify some other suitable investors for their first institutional funding round.

The main challenge for Blinkist in 2013-2014 was the following:

Uncertainty on potential traction channels: Like every early stage startup they were focusing on a certain set of audiences, traction channels and revenue and pricing models etc. and were not really able to step outside of their current activities (due to the fact that they didn’t want to lose focus and they had limited resources). They never thought about (or did only very limited steps into this direction) expanding the value proposition and product/services to a completely different audience and market, like B2B or B2B2C targeting corporations (and their education programs) or media partnerships (providing their content via partners).

1. B2B / B2B2C Strategy and Setup:

We started working with Blinkist on identifying, how the current consumer value proposition could be applied to a corporate or a media partnership environment. The activities comprised to understand how the selling proposition and product / platform features would need to be adapted to these markets, what pricing could be defined and how the channels and processes could be put in place. We worked on identifying the most prominent segments in the market, on the potential product feature specifications, on sales pitches and on pricing definitions to name a few.

2. B2B / B2B2C Testing and Validation:

As part of our work we also tested (with a limited budget) the new approach, trying to validate the value proposition, in order to provide a decision making basis for the management team, to further invest or not into these new audiences and segments. We tried a very broad range of traction channels, like cold calls, cold emails, LinkedIn outreaches and messagings, 2nd rank introductions, retargeting (where possible), in both domestic and international markets.